ABOUT US

We provide the best insurance policy

“Perfection is not attainable, but if we chase perfection, we can catch excellence.”

- Vince Lombardi

The agency owner, Gary Owen, has been a Florida resident since 1986. He is a graduate of the American College with the esteemed “LIFE UNDERWRITING TRAINING COUNCIL FELLOW” designation.

-

He brings vast experience and knowledge, having successfully worked in the insurance field as an insurance adviser and also many years as an executive with a national Medicare carrie

-

Gary also is a national speaker on Medicare with the National Association of Health Underwriters

-

Rest assured, we will listen to your needs and we’ll only recommend the plans that are the most suitable for your specific situation.

400+

Insurance Advisors

3000+

Satisfied Clients

17+

Years Of Experience

800+

Seminars Conducted

TYPE OF POLICIES

We cover all fields of insurance

Medicare Insurance

Nobody does Medicare planning better than our team of professionals. We represent most of the Medicare carriers and plans available.

Life Insurance

Over 41% of Americans have NO life insurance and more than half that have it, don’t have enough. Click below to get a free customized quote.

Annuities

Protect your nest egg from becoming scrambled eggs. You worked hard for your retirement so consider a safe investment vehicle providing a lifetime of income.

Short Term Medical

Short-Term Medical insurance (from 1 month to 3 years) gives you affordable and flexible plan choices to face those unpredictable moments in life with confidence.

Long-Term Care

You need an action plan for Long Term Care. 52% of people turning 65 will need some type of long term care services in their lifetime.

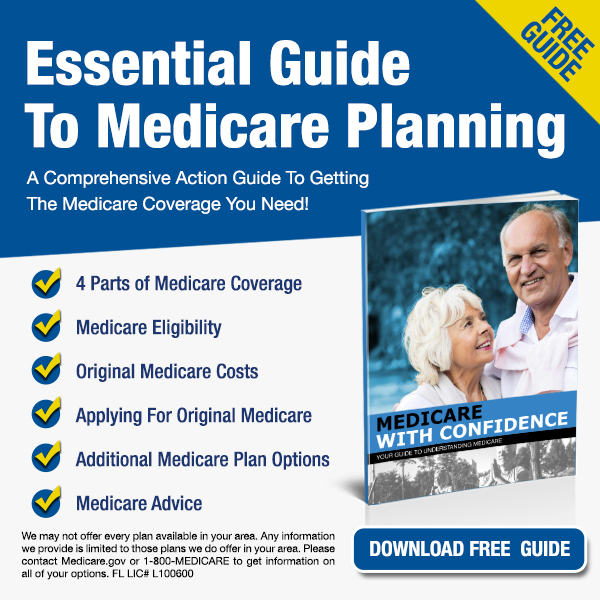

MEDICARE GUIDE

Get Our Free Medicare Guide

TESTIMONIALS

What our customers say

Frank E. K.

Palm City, FL

I have found this company extremely reliable and trustworthy. Mr. Owen has gone out of his way to bring me the best possible information regarding...

Sherry S.

West Palm Beach, FL

Highly recommend Gary Owen. Professional and knowledgeable in the Insurance Industry. Motivated with spirit and cares about YOU! If you want to exp...

Frank E. K.

Palm City, FL

I have found this company extremely reliable and trustworthy. Mr. Owen has gone out of his way to bring me the best possible information regarding policy coverage comparisons re. co-pay, premiums, etc.

Sherry S.

West Palm Beach, FL

Highly recommend Gary Owen. Professional and knowledgeable in the Insurance Industry. Motivated with spirit and cares about YOU! If you want to expand your knowledge, he is very capable when it comes to offering you the sound advise you require.

OUR BLOG

Read our stories

.png)

The Unparalleled Commitment of Gary's Team: A Pers...

Discover the exceptional insurance services provided by Gary and his team, offering personalized gui...

.png)

Navigating Medicare with Confidence: A Personal Jo...

Discover the inspiring story of overcoming Medicare challenges with the help of a trusted insurance...

.webp)

Medicare Supplement And Dental

Tune-in NOW to our live, fun, informative, and popular radio show! This will be a great show that yo...